The push by the Republican majority in the U.S. Congress for a major overhaul of the nation’s tax legislation before the end of the year is confronting geoscience graduate students with the possibility of a sharp tax increase. The steep jump in income tax would effectively slash funding for their educations, say student advocates and others.

The threat lurks in a House plan to tax tuition waivers as income. It could increase taxes on all graduate students, including those in the Earth and space sciences, by up to sevenfold, according to a national organization that represents graduate students.

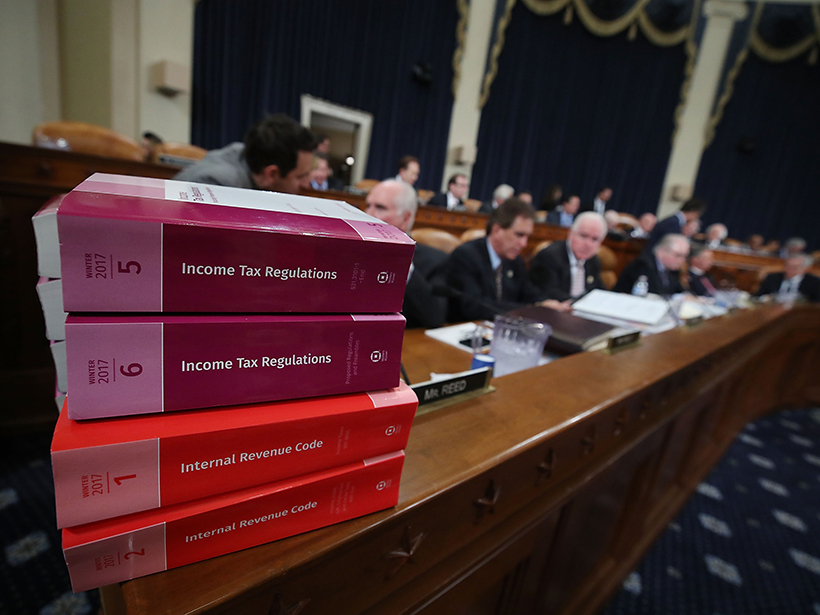

House bill H.R. 1, titled “Tax Cuts and Jobs Act,” would reverse the current tax code by considering college tuition assistance, reductions, and waivers taxable income. Released by House Ways and Means Committee chairman Kevin Brady (R-Texas) on 2 November, the plan prompted a widespread outcry from graduate students and professors in science, technology, engineering, and mathematics (STEM) programs who said that the bill would hurt U.S. higher education and restrict it to individuals from high-income families.

The legislation would “absolutely hurt the United States,” declared the National Association of Graduate-Professional Students (NAGPS), a student-run advocacy group for graduate and professional students across the United States.

The Tax Cuts and Jobs Act will adversely impact the higher education community which will absolutely hurt the United States.. we need researchers! #ReworkTheReform #NAGPS4U

— NAGPS (@NAGPS) November 7, 2017

The proposed tax reform bill would make it nearly impossible to be a graduate student without holding another job. #ReworkTheReform

— NAGPS (@NAGPS) November 6, 2017

However, to the relief of many graduate students and professors, the Senate Committee on Finance’s version of the Tax Cuts and Jobs Act, released a week after its House counterpart, maintains tax-free tuition waivers, a long-standing means by which universities provide financial support to graduate students who work as instructors. Still, not knowing how Congress will reconcile the differences between its tax plans leaves open the possibility of an economically painful future for graduate students.

Limiting Higher Education to Higher Income

The current Internal Revenue Service code allows colleges and universities to provide nontaxable tuition assistance, reductions, or waivers to employees and their spouses or dependents. This provision lowers the cost of postsecondary education by giving Ph.D. and master’s graduate students nontaxable tuition waivers for their service as teaching or research assistants.

According to the Council of Graduate Students, if tuition waivers become taxable, doctoral students could see tax hikes between 100% and 200%, and master’s students could see increases up to 600% as they are taxed on “income” that they never see. The anonymous Twitter account LegoGradStudent, which humorously portrays real-life graduate school scenarios, showed the difference in taxable income for graduate students under the current law and the House bill.

[Updated] The proposed GOP tax bill would slam grad students and schools by taxing tuition waivers. Learn more: https://t.co/1GwFT077kI pic.twitter.com/pUjwQebM7l

— Lego Grad Student (@legogradstudent) November 7, 2017

After the House plan’s unveiling, many geosciences graduate students, professors, and scientists spoke out about how students from low- and middle-income families would be hit hard by taxes imposed on tuition waivers. According to prominent astronomer and astrobiologist Lucianne Walkowicz of the Library of Congress in Washington, D. C., and the Adler Planetarium in Chicago, Ill., the proposed tuition assistance tax would have prevented her from going to grad school.

Christine Mirzayan Science and Technology Policy Graduate Fellow Joseph Schmitt at the National Academies of Sciences, Engineering, and Medicine calculated how he would have been affected by the House tax bill had it been in effect while he was pursuing his Ph.D. in astronomy from Yale University in New Haven, Conn.

Under GOP tax plan, I would’ve paid $10,000 more in federal taxes for 2016, making my total effective tax rate ~50% of my stipends/side jobs

— Joey (for #DCstatehood) (@JoeySchmittPhD) November 7, 2017

“If this goes through and nothing is done about it, we’re going to have to drop out and not finish our degrees.”

Other graduate students have expressed concern that the provisions in the House’s bill might drive enrolled students out of their Ph.D. programs. “If you don’t already have money, you’re really going to have a hard time paying for graduate school and supporting yourself,” Jenna Freudenburg, a graduate student in astronomy at Ohio State University in Columbus, told ABC News. Speaking for herself and her peers, Freudenberg added that “if this goes through and nothing is done about it, we’re going to have to drop out and not finish our degrees.”

The House Ways and Means Committee approved H.R. 1 on 9 November after a week of debate. Yesterday, the full House of Representatives passed the bill by a 22 vote margin, to the satisfaction of the chamber’s Republican leaders.

This is an historic day. We delivered on our promise to cut taxes & create jobs—to ensure America remains a great place to do business. pic.twitter.com/AkD24AGjme

— Paul Ryan (@SpeakerRyan) November 16, 2017

How Much Senate Protection?

Using data from the U.S. Department of Education, the American Council on Education reported that more than 145,000 graduate students received some form of tuition assistance in 2011–2012. Nearly 60% of those tuition reductions went to graduate students in STEM fields. Analysis by the Joint Committee on Taxation concluded that repealing some education provisions, including Section 117(d) tuition reduction assistance, would raise $45.1 billion over 10 years.

However, academics, including Michael Mann, a climate scientist and professor of geosciences at Pennsylvania State University in University Park, have said that the additional revenue, which would offset the money lost from tax cuts for higher income brackets, may critically damage the United States’ future and competitiveness in scientific research.

So congressional Republicans are happy to destroy STEM graduate education (and our future competitiveness in sci tech as a nation) if it helps them pay for a tax break for the wealthiest 1%. Via @voxdotcom: https://t.co/44xaqD71Pe

— Michael E. Mann (@MichaelEMann) November 8, 2017

The Senate Finance Committee’s post-markup bill, which passed through committee late last night, maintains the status quo regarding tax-free tuition waivers, and none of the more than 350 proposed amendments to the bill sought to change that. The exclusion from the Senate bill of the House bill’s worrisome tax changes led to cautious optimism from some advocates for graduate and professional students.

In a statement to Inside Higher Ed, Sam Leitermann, president and CEO of NAGPS, expressed satisfaction that the Senate’s initial bill did not change the provisions most critical to grad school affordability but also reaffirmed his organization’s commitment to lobbying the tax plans’ authors on behalf of graduate students.

“It’s early,” Leitermann said, “so things can change on the Senate side….We’ll keep pushing both the House and Senate to protect us.”

The Road Ahead for Tax Reform

Senate Finance Committee chairman Orrin Hatch (R-Utah) told reporters late Wednesday that his committee’s debates over the bill might extend through today or Saturday. However, committee Republicans advanced the bill late last night after many hours of contentious debate. Senate Majority Leader Mitch McConnell (R-Ky.) had expressed his hope that the committee would approve its bill by today so that the legislation can be considered by the full Senate the week after Thanksgiving. Treasury Secretary Steven Mnuchin said that he expects the House and Senate to agree on a compromise tax bill, pass it, and present it to the president by the end of 2017.

In the meantime, two key questions remain for graduate students: Will the compromise bill more closely resemble the House’s bill or the Senate’s? And will the tax revisions affect the remainder of the 2017–2018 academic year or be delayed until the following semester?

In the House bill that passed yesterday, the tuition assistance provision would come into effect for amounts paid or incurred after 2017. If the provision survives the reconciliation process with the Senate bill, most spring 2018 tuition waivers, which are paid toward the end of 2017, would remain tax free, but summer 2018 tuition waivers would be taxed.

With many more changes to come in the tax plans, “colleges, universities and students should take nothing for granted.”

Even if the Senate’s approach to tuition waivers prevails, the higher education community is bracing for potential further bad news. “The legislative process is just beginning,” Craig Lindwarm, director of congressional and governmental affairs at the Association of Public and Land-grant Universities, told Inside Higher Ed, “and some of the most concerning provisions can be added throughout this process.”

With many more changes to both bills likely to come before they are signed into law, advocates of higher education advise caution.

Lindwarm added that “colleges, universities and students should take nothing for granted.”

—Kimberly M. S. Cartier (@AstroKimCartier), News Writing and Production Intern

Editor’s note: The American Geophysical Union and other professional institutions cosigned a letter to Congress opposing the Tax Cuts and Jobs Act on 15 November.

Correction, 17 November 2017: This article has been updated to reflect the advancement of the Tax Cuts and Jobs Act out of the Senate Committee on Finance late on 16 November.

Citation:

Cartier, K. M. S. (2017), Divergent republican tax plans blur future for grad students, Eos, 98, https://doi.org/10.1029/2017EO087163. Published on 17 November 2017.

Text © 2017. The authors. CC BY-NC-ND 3.0

Except where otherwise noted, images are subject to copyright. Any reuse without express permission from the copyright owner is prohibited.