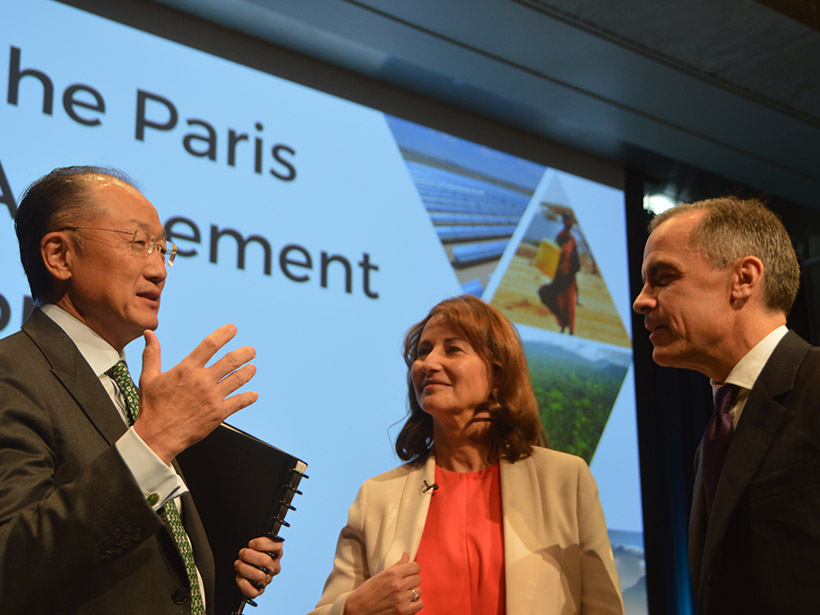

Countries must act quickly on climate change to meet the ambitious goals agreed upon in last December’s climate summit in Paris, World Bank Group president Jim Yong Kim said at a forum last week at World Bank headquarters in Washington, D. C.

The world needs “to move right now” to put in place strong mitigation and adaptation measures, slow the rate of greenhouse gas emissions, and mobilize the financial markets to dramatically increase their investments in clean energy, Kim said at the forum, which focused on putting the Paris agreement into action.

The 14 April forum took place days before more than 150 world leaders will meet on 22 April at a United Nations (UN) ceremony to sign the Paris agreement that emerged from the 21st conference of the parties (COP 21) of the UN Framework Convention on Climate Change. That agreement calls for holding the increase in the global average temperature to well below 2°C above preindustrial levels and pursuing efforts to limit the increase to 1.5°C to reduce the risks and impacts of climate change. The agreement will come into force after at least 55 parties representing at least 55% of total global greenhouse gas emissions ratify it. A major follow-on UN climate meeting, COP 22, will take place in Marrakech in November.

Changing the Incentives

“If we think that the signing of an agreement in Paris will lead to all of these changes in time to keep global warming below 2°C, I think we are sadly mistaken.”

Kim said he assumes that most countries will not live up to the emission reduction promises of change that they made in the pressure-cooked atmosphere of the Paris summit. “If we think that the signing of an agreement in Paris will lead to all of these changes in time to keep global warming below 2°C, I think we are sadly mistaken,” he stated. Kim said pressure needs to be maintained and financial instruments implemented to convince countries to make progress in reducing greenhouse gases not just from a moral responsibility but also because it’s best for their bottom line. “We have got to do everything we can to change the incentives,” he said.

In Vietnam, coal costs 9–10 cents per kilowatt hour, whereas solar energy runs 12 cents per kilowatt hour there even though it costs less in other countries, including Peru and Mexico, according to Kim. Given Vietnam’s lower coal costs, the country plans to install 40 gigawatts of coal-based power soon. That amount of power equates to half the electricity-generating capacity of all of sub-Saharan Africa, Kim noted.

Finding a solution in Vietnam and elsewhere requires linking policy change to specific financing mechanisms to bring down the cost of renewables, he asserted, so that “whatever a country or a leader feels about addressing climate change, the financial argument is so powerful that they have to move toward renewables.”

Financial Opportunity

Investing in clean energy can take off if the financial community gets assurances that it is a sound financial decision.

Mark Carney, governor of the Bank of England and chairman of the Financial Stability Board, an international body that monitors the global financial system, said at the forum that investing in clean energy can take off if the financial community gets assurances that it is a sound financial decision. He said that institutional investors currently hold about $100 trillion in fixed income assets, but they invest less than 1% of that in anything that approximates renewable or green financing.

“We are in a world of very low interest rates with huge pools of institutional capital that are looking for longer-term assets that provide some yield and provide some diversification,” he said, adding that renewable energy could provide some of that diversification if investors have the right information, financial tools, and incentives.

The Big Losers

Kim said that losers in the shift to renewable energy will be people “who refuse to look at the science” and those who “refuse to understand the implications of climate change.” He added that without clear and immediate action on climate change, “the real losers will be every single one of our children and grandchildren.”

Forum attendee Trevor Davies, who leads auditing firm KPMG’s International Development Assistance Services Global Institute, told Eos that although he agrees with most of Kim’s comments, some other people and industries could be losers as well and ignoring that doesn’t help the situation. “If the U.S. was to move away from coal, what impact would that have on the states where coal mining is a significant factor?” he asked. “You need to think about what mitigation action you can take if you go down that path.”

—Randy Showstack, Staff Writer

Citation: Showstack, R. (2016), Finance head urges strong climate mitigation, adaptation steps, Eos, 97, doi:10.1029/2016EO050909. Published on 20 April 2016.

Text © 2016. The authors. CC BY-NC-ND 3.0

Except where otherwise noted, images are subject to copyright. Any reuse without express permission from the copyright owner is prohibited.