The global economy is unprepared to meet the exploding demand for critical minerals. These materials, many of which were of little economic interest until recently, are required to fuel a proliferation of technologies and industries that have become vital for social and economic well-being the world over. But supplies of critical minerals are at risk because of their natural scarcity and because of geopolitical issues and trade policies that complicate their distribution, among other factors.

Growing reliance on critical minerals has intensified global competition to identify new sources and establish stable, long-term supply chains of these natural resources.

Critical minerals such as gallium, indium, and the rare earth elements (REEs) are indispensable in the operation of the electronics that run our computers and the devices that display our data. Others containing phosphorus and potassium fertilize fields that feed the growing global population and are even active ingredients in pharmaceuticals. New metal alloys made with critical minerals are used to produce lighter, stronger materials that increase vehicle fuel efficiency. Lighter vehicles, many of which use new battery materials derived from critical minerals (e.g., lithium, cobalt, nickel), are transforming our transportation systems. Critical minerals essential for the development of new energy-related technologies that support the shift to noncarbon-based energy sources are becoming especially important.

Growing reliance on critical minerals by nearly all industrial sectors, including military and defense, has intensified global competition to identify new sources and establish stable, long-term supply chains of these natural resources. These tasks are complicated by the accelerating rate at which technologies are advancing, which makes it difficult to predict what critical minerals—and what quantities—will be required in the future.

In December 2019, the Critical Minerals Mapping Initiative (CMMI), a research collaboration among scientists from three nations, convened its inaugural meeting in Ottawa, Canada. This initiative, which includes representatives from the Geological Survey of Canada, Geoscience Australia, and the U.S. Geological Survey (USGS), aims to harness the combined geological expertise of these organizations to address global natural resource vulnerabilities. Here we outline these vulnerabilities and present outcomes from this inaugural meeting.

What Are Critical Minerals?

No longer is the periodic table of elements a tool only for scientific specialists and chemistry students. With the explosion of critical mineral−based technologies required to sustain 21st century economies, we can annotate the table to show parameters critical to industrialists, manufacturers, economists, and government and military officials (Figure 1).

Technological innovation, metallurgical and extractive advances, geopolitics, and economic trade tensions all ensure these lists of critical minerals are constantly evolving.

Market volatility has inspired the “criticality” concept, which incorporates supply risk, environmental impact, and potential consequences of supply restriction [Graedel et al., 2015]. In this context, critical minerals are defined as metal and nonmetal elements and compounds considered vital to economic and national security yet whose supplies may be at risk because of geological scarcity, geopolitical issues, trade policies, or other factors related to extraction, refining, and transport. (This usage of “minerals” differs somewhat from the scientific meaning, which refers to naturally occurring solids with defined compositions and crystal structures. “Critical minerals” comprise some materials that fit the scientific definition of minerals as well as elements, such as the REEs, and compounds that do not.) Accordingly, many countries have developed lists of critical minerals.

Although these lists vary depending on specific national concerns, Figure 1 shows that they overlap significantly. Technological innovation, metallurgical and extractive advances, geopolitics, and economic trade tensions all ensure these lists of critical minerals are constantly evolving, and the only certainty among them is that they are ever expanding. For example, fabrication of high-speed, high-capacity integrated circuits required only 12 minerals in the 1980s but more than 60 by the 2000s. Building a modern cell phone now requires materials containing 75 minerals, comprising elements covering about two thirds of the periodic table.

Uneven Distribution and Supply Chain Pinch Points

Multiple issues converge to threaten a stable supply of critical minerals, but the challenge, at its core, reflects a complex interplay between physical rarity (naturally occurring mineral abundances) and economic scarcity [Nassar et al., 2020; Schulz et al., 2017].

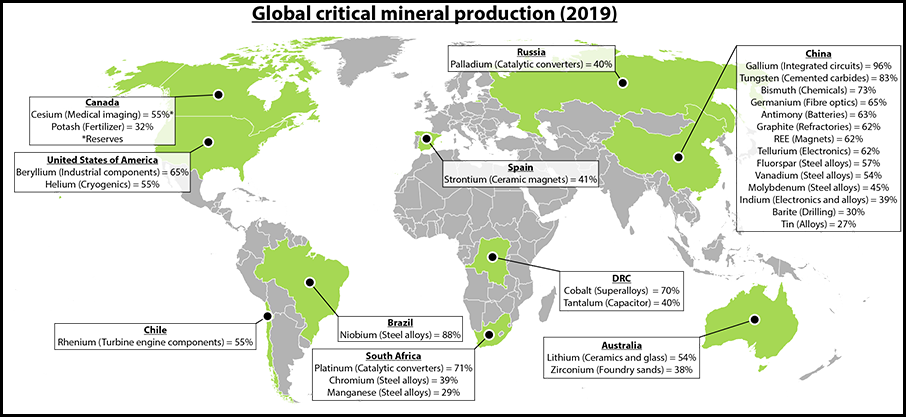

Physical rarity is a major issue largely because critical minerals are not distributed uniformly around the planet (Figure 2). No country is fully self-sufficient in meeting all its mineral resource needs, and the asymmetric distribution of critical minerals has promoted supply reliability concerns associated with trade tensions, political turmoil, and resource nationalism in major supplier countries [Nassar et al., 2020]. Recent critical mineral supply chain disruptions, such as in Congo and China, underscore the geopolitical vulnerability that high-tech industries endure relative to the behavior of suppliers and international governments.

The REE crisis, which came to a head a decade ago, is an instructive example of how economic scarcity contributes to supply chain vulnerability. A subset of seven of these elements called the heavy rare earth elements (HREE; generally defined as terbium and heavier elements; Figure 1) is indispensable to emerging technologies, especially in green energy, defense, and electronics applications. Currently, virtually all HREEs are mined from low-grade ion-adsorption clay-type deposits in southern China. The low-cost mining of these clay-type deposits allowed China to dominate more than 95% of global REE production by 2011 [Van Gosen et al., 2019]. That year, China cut REE export quotas by 40%, resulting in market turmoil and a price surge for some REEs of as much as 3,000%. This event triggered a massive effort by private industry and academic and government research organizations to locate new sources of REEs and research possible substitutions of other materials for REEs in manufacturing.

Already discovered, but unexploited, igneous-related carbonatite deposits were ready sources of light REEs, but economically viable sources of HREEs remain elusive, and adequate HREE substitutes for practical applications have yet to be identified. More recent research has identified promising new and unconventional HREE sources, such as REE-enriched deep-sea muds [Takaya et al., 2018] and REE-enriched sedimentary phosphate deposits [Emsbo et al., 2015]. But these sources will take years, or even decades, to develop. Consequently, after a costly, decade-long scientific effort (a lifetime in economic terms), the supply of HREEs still poses a significant geopolitical issue.

Another daunting challenge associated with critical minerals is that they predominantly occur as accessory commodities in several conventional mineral deposit types and are by-products in the processing of these deposits. Furthermore, the revenue generated by critical mineral recovery and market size is generally minimal relative to that from the associated primary commodities. Critical mineral distribution within ores also remains poorly understood, and this distribution is rarely considered during mine planning. Accordingly, current operations are unlikely to be able to increase supplies of critical minerals to meet increased demand.

Moreover, as the space accessible to current surface and near-surface mineral exploration methodologies, developed for conventional metal deposit over centuries, nears exhaustion, these techniques are becoming less effective in discovering new deposits. For example, expenditures for exploration in search of new copper deposits increased by an order of magnitude between 2003 and 2013, triggered by near-exponential growth in demand for the metal in power transmission and generation applications such as building wiring, telecommunication, electric vehicles, and electronic products. However, these efforts have not yielded significant copper discoveries since 2008 or a single new giant deposit in the past 25 years (Figure 3). Repercussions of this dwindling exploration yield extend to supplies of critical minerals like selenium, tellurium, molybdenum, cobalt, and rhenium because copper ore deposits are a primary source of these elements, which are used in the electronics, catalyst, and semiconductor industries.

We thus require new sources of critical minerals. Yet exploration targeting is made significantly more challenging because very little is known about the occurrence and geological processes that concentrate many of these critical minerals into economic deposits.

Harnessing Geological Knowledge and Data

In light of the scope and urgency of this issue, the trinational CMMI was launched to integrate the geological knowledge and data of our national surveys to identify new sources of critical minerals. Our survey institutions are well positioned to meet this challenge—we currently house unparalleled, national-scale geophysical, geochemical, and geological data, which we combine with state-of-the-art research on the origins of critical mineral deposits. Furthermore, our mission to serve the public and provide unbiased science constitutes a natural nexus amid the motivations of university, industry, and national research entities, all of which play roles in identifying undiscovered mineral resources.

At the inaugural meeting of the CMMI collaborative, participants from each of these sectors contributed to define a systematic research strategy to pursue this purpose [Kelley, 2020]. A natural first step is the creation of a public, online geochemical database inventorying critical mineral data from our respective countries. This database is being seeded with critical mineral data from archived samples taken from previously mined deposits [Granitto et al., 2020] and data from modern mines [Huston and Brauhart, 2017]. These data will be supplemented by other national geochemical data sets to produce seamless coverage of all three CMMI countries, which together make up most of two continents.

Systematically characterizing the critical mineral contents of ores from different deposit types will help us assess the presence and amounts of critical minerals in our nations’ previously mined deposits.

Systematically characterizing the critical mineral contents of ores (i.e., geochemical fingerprinting) from different deposit types will help us assess the presence and amounts of critical minerals in our nations’ previously mined deposits. (Most deposits mined historically have been explored without consideration of critical minerals because, at the time, these minerals were not of commercial interest, were difficult to analyze for, or, in some cases, had not yet been discovered.) This effort will also highlight opportunities to find critical minerals in legacy mining waste and enable prediction of critical mineral concentrations in unsampled deposits. For example, geochemical fingerprinting of phosphate deposits in the United States has shown that they could supply the world’s demand for HREE for the foreseeable future [Emsbo et al., 2015], a finding that has spurred a similar assessment now underway in Australia. We anticipate that this trinational collaboration may identify other previously unconsidered sources of critical minerals.

Importantly, fingerprinting the critical mineral signature of different deposit types will also provide empirical data to support state-of-the-art mineral research. Combining these new geochemical data with geochronologic, mineralogic, and isotopic studies as well as geological and geophysical mapping and field observations will increase understanding of the complex physical, chemical, and geological processes that accumulate critical minerals in Earth’s crust.

This work will allow us to identify proxies—visible identifiers—to map the range of tectonic, magmatic, structural, hydrothermal, metamorphic, oceanographic, and surficial processes deemed essential to source, transport, and concentrate critical minerals. Robust benchmarking of these mineral system proxies will help us identify promising regions for mineral exploration and will reduce uncertainty, risks, and costs for industry exploration activities [cf. Hoggard et al., 2020]. Ultimately, we plan to combine these proxies using advanced numerical methods to assist industry and government stakeholders in making strategic exploration, economic, and land use decisions, particularly as mineral exploration moves into more remote and deeper geological environments.

With a sustained effort, the CMMI will unite the scientific expertise of our three geological surveys to help advance critical mineral science; mitigate supply risks for Australia, Canada, and the United States; and safeguard supplies in support of the United Nations’ Sustainable Development Goals. In the interest of scientific transparency and broadening collaboration, we are sharing updates and findings from CMMI’s efforts, including at a dedicated technical forum under the auspices of the World Community of Geological Surveys in February 2021. We welcome participants interested in working together to meet the scientific challenges associated with ensuring critical minerals supplies in the future.

Acknowledgments

Vic Labson, director of USGS’s Office of International Programs, was a founding member and a dedicated force behind this collaboration. His vision and diplomacy initially drew support from Canadian Targeted Geoscience, Australian Exploring for the Future, and USGS Earth Mapping Resources initiatives. We are saddened that he did not see this vision transform into reality because of his untimely passing on 1 November 2020. He leaves a rich legacy of the 44 geoscientists and staff (and growing) from three nations (and growing), all working collaboratively to tackle complex problems associated with critical mineral security. Reviews from Bradley Van Gosen, Philip Verplanck, Jan Peter, Allison Britt, and Geoff Fraser improved this article.

References

Emsbo, P., et al. (2015), Rare earth elements in sedimentary phosphate deposits: Solution to the global REE crisis?, Gondwana Res., 27, 776–785, https://doi.org/10.1016/j.gr.2014.10.008.

Graedel, T. E., et al. (2015), Criticality of metals and metalloids, Proc. Natl. Acad. Sci. U. S. A., 112(14), 4,257–4,262, https://doi.org/10.1073/pnas.1500415112.

Granitto, M., et al. (2020), Global geochemical database of critical minerals in archived mine samples, data release, U.S. Geol. Surv., Reston, Va., https://doi.org/10.5066/P9Z3XL6D.

Hoggard, M. J. (2020), Treasure maps for sustainable development, Springer Nature Sustainability Community, bit.ly/2NjNfPU.

Hoggard, M. J., et al. (2020), Global distribution of sediment-hosted metals controlled by craton edge stability, Nat. Geosci., 13, 504–510, https://doi.org/10.1038/s41561-020-0593-2.

Huston, D. L., and C. W. Brauhart (2017), Critical commodities in Australia: An assessment of extraction potential from ores, Record 2017/14, Geosci. Aust., Canberra, https://doi.org/10.11636/Record.2017.014.

Kelley, K. D. (2020), International geoscience collaboration to support critical mineral discovery, Fact Sheet 2020-3035, 2 pp., U.S. Geol. Surv., Reston, Va., https://doi.org/10.3133/fs20203035.

Nassar, N. T., et al. (2020), Evaluating the mineral commodity supply risk of the US manufacturing sector, Sci. Adv., 6(8), 1–11, https://doi.org/10.1038/s41561-020-0593-2.

Schulz, K. J., et al. (Eds.) (2017), Critical mineral resources of the United States—Economic and environmental geology and prospects for future supply, U.S. Geol. Surv. Prof. Pap., 1802, A1–A14, https://doi.org/10.3133/pp1802A.

Takaya, Y., et al. (2018), The tremendous potential of deep-sea mud as a source of rare-earth elements, Sci. Rep., 8, 5763, https://doi.org/10.1038/s41598-018-23948-5.

Van Gosen, B. S., P. L. Verplanck, and P. Emsbo (2019), Rare earth element mineral deposits in the United States, U.S. Geol. Surv. Circ., 1454, 16 pp., https://doi.org/10.3133/cir1454.

Author Information

Poul Emsbo ([email protected]), U.S. Geological Survey, Denver, Colo.; Christopher Lawley, Geological Survey of Canada, Ottawa, Ont.; and Karol Czarnota, Geoscience Australia, Canberra, ACT

Citation:

Emsbo, P.,Lawley, C., and Czarnota, Karol. (2021), Geological surveys unite to improve critical mineral security, Eos, 102, https://doi.org/10.1029/2021EO154252. Published on 05 February 2021.

Text © 2021. The authors. CC BY-NC-ND 3.0

Except where otherwise noted, images are subject to copyright. Any reuse without express permission from the copyright owner is prohibited.