Homeowners in the United States are facing significant impacts from increasing flood risk, yet they do not have access to the tools necessary to understand that risk. A nonprofit recently formed by the authors, First Street Foundation, is dedicated to defining this flood risk and offering actionable data to property owners. In June, we launched an assessment tool based on peer-reviewed science and a combination of public and private data sources that assigns a score for each of the approximately 145 million real estate parcels in the contiguous United States. Each property’s “Flood Factor” allows buyers to be better informed when purchasing a new home and enables current homeowners to take action based on climate prediction data.

Challenges in Understanding Flood Risks

A recent study estimated that 41 million U.S. real estate parcels—more than 25% of the nation’s homes—are currently subject to 1-in-100-year flood and inundation risks due to riverine (fluvial) and rainfall (pluvial) influences [Wing et al., 2017]. In April, the McKinsey Global Institute published a report that looked at how physical, economic, and demographic vulnerabilities resulting from climate influences compound these flood risks. From a purely economic perspective, rising sea levels have already caused losses of $15.9 billion in appreciation of property values along the U.S. East and Gulf Coasts, including more than $465 million in real estate value loss in Florida’s Miami-Dade County alone [McAlpine and Porter, 2018].

FEMA has designated only around 5% of the nation’s properties to be within 1-in-100-year Special Flood Hazard Areas. This vastly underestimates the number of at-risk properties.

The information available for the public to easily understand these flooding risks is limited. The U.S. Federal Emergency Management Agency (FEMA) has designated only around 5% of the nation’s properties to be within 1-in-100-year Special Flood Hazard Areas (SFHAs). This vastly underestimates the number of at-risk properties, and the methodology used does not address future climate change concerns yet is typically presented to prospective home buyers as the only flood information for a property. Although SFHA designations are made available to the public, the nuances of designations and flood risk may be more difficult to convey. Although other technical flooding information (e.g., nuisance flooding predictions, flash flood evacuation zones) is often distributed by other federal agencies and local entities, owners and buyers may not understand how to prioritize flood risks relative to other real estate characteristics such as price and ease of commute. In addition, buyers’ perceived risks tend to diminish as time increases since the last local flooding event [Bin and Landry, 2013].

Climate change is perniciously increasing the flood risk profile of many U.S. properties. Changing patterns, quantity, and duration of precipitation [e.g., Kunkel et al., 2020], as well as increasing sea levels and storm severity, impose additional levels of flooding and inundation risk to property owners. Although there are many examples of national, state, and local assessments of the impacts that a changing climate will bring, it is difficult for individual property owners to understand their specific risks.

The First Street Foundation, a research and technology nonprofit, was formed in response to this national need.

Developing a Science-Based Assessment Tool

First Street created its flood risk assessment tool by using a hydrological model of the contiguous United States that was fed open data from national and commercial databases and augmented with its own regional infrastructure documentation.

First Street created its flood risk assessment tool by using a hydrological model of the contiguous United States that was fed open data from national and commercial databases and augmented with its own regional infrastructure documentation. We commissioned a series of probabilistic simulations by the U.K.-based hydrologic research group Fathom using this 30-meter-resolution, 2D model [Wing et al., 2017]. That model was fed coastal sea level and surge impact data from the Rhodium Group (collected via techniques described by Kopp et al. [2017] and Emanuel [2017]), elevation data from the U.S. Geological Survey (USGS), rainfall distributions from the National Oceanic and Atmospheric Administration’s (NOAA) National Weather Service Atlas 14, coastal water levels from NOAA’s Center for Operational Oceanographic Products and Services, and levee data from the U.S. Army Corps of Engineers (USACE). We also partnered with LightBox, leveraging its proprietary, high-quality parcel data.

These commissioned simulations included current environmental conditions, as well as climate conditions, including precipitation changes and sea level rise, projected for 2035 and 2050 described by the Intergovernmental Panel on Climate Change Representative Concentration Pathway projection 4.5 [Moss et al., 2010]. We further interpolated these results in 5-year increments from 2020 to 2050 and across a range of annual flood probabilities from 0.2% (1 in 500) to 50% (1 in 2).

We evaluated the results by state, enabling postprocessing tailored for local real estate policies and practices, such as tax assessments. High-resolution ancillary data provided by commercial partners added detail for real estate parcel geometries and characteristics. Finally, statistics for flood depth and frequency are calculated for each real estate parcel.

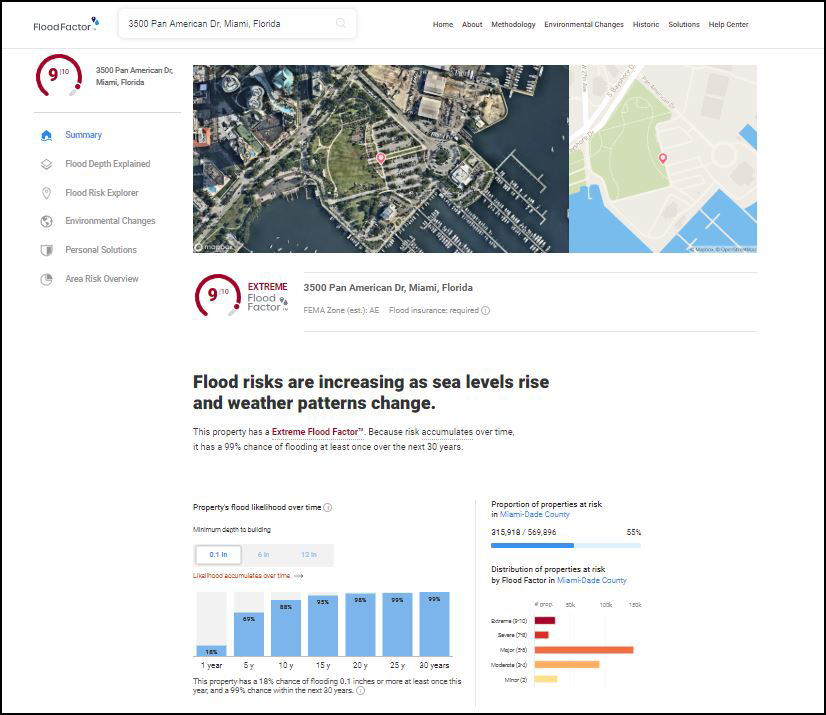

From these results, each parcel is assigned a Flood Factor that describes on a simple scale from 1 (minimal) to 10 (extreme) its flooding and inundation risk over a cumulative 30-year period, the typical length of a home mortgage. The risk score encapsulates both the likelihood of flooding and the severity (depth) of flooding in a single number, assigned on the basis of the likelihood of flooding at each of several depth thresholds. The cumulative nature of the score captures both today’s flood risk and that of the future under changing environmental conditions. For example, First Street has estimated that there are over 248,000 properties in the New Orleans, La., area that today have a minor flood risk and are appropriately zoned in an SFHA but are estimated by First Street to have extreme risk by 2050 as existing levees are overtopped by rising sea levels. The numerical Flood Factor score (e.g., 10 out of 10) should convey the level of risk more intuitively to the residents than the official FEMA flood zone naming system (A, B, C, AE, AH, AO, AR, D, V, VE, X, etc.), which requires explanation and interpretation.

Free Public Access to Flood Risk Estimates for Each Property in the United States

The Flood Factor estimates, which can be accessed through an address search or our interactive map, are freely and publicly available under a noncommercial-use data sharing license beginning on 29 June 2020. The risk score estimates are provided in context with the property details, descriptions of flood types, and information about environmental changes. Academic researchers interested in using these data for academic studies and societal benefits are encouraged to contact First Street about participating in its Flood Lab. We are also gauging interest from public sector entities who may wish to use First Street data for informed decision-making and planning purposes for their communities. Cloud-based application programming interfaces (APIs) to enable bulk data access are available, and commercial entities who are interested in accessing such services should contact First Street for options.

We are hopeful that free public access to this information will enable stakeholders to understand their personal flooding risk. Homeowners then have a better foundation of knowledge to pursue action that may reduce, mitigate, or allow them to adapt to that risk, including modifying their properties, advocating for effective local water management practices, and purchasing insurance from private industry or FEMA’s National Flood Insurance Program. We are collecting feedback from users who may wish to contribute comments, property flooding history, or information about additional local adaptation or mitigations efforts that have not been adequately captured in the Flood Factor assessments. In particular, although our current risk estimates consider the influence of over 23,000 adaptation features, we seek local help in documenting and understanding the operations of additional adaptations, such as those protecting smaller areas (50 properties or fewer) and green infrastructure. These contributions and feedback will enable continuous improvement to the assessment processes and increase the quality of future risk data.

Flood Factor’s Impact

First Street’s Flood Factor scores indicate that 1.7 times as many properties in the continental United States are at significant risk (1% annually) of flooding than are included in today’s SFHAs, and within 30 years an additional 10% of properties are expected to reach that same level of risk. Our goals are to provide resources that allow individuals to make informed decisions and to drive national and local innovation to reduce exposure to flooding risks. Property values have already begun to reflect this risk, and we understand that by providing wide access to the realities of increased risk, we could accelerate changes in property values where the risk was previously not well understood. The new risk information may also have influence on flood insurance markets, as well as on individuals’ decisions to purchase insurance.

Our research partners are tasked with shining a light on the socioeconomic and public policy implications of the First Street flood risk estimates, including impacts on disadvantaged communities.

These ramifications are the impetus behind our Flood Lab, where our research partners are tasked with shining a light on the socioeconomic and public policy implications of the First Street flood risk estimates, including impacts on disadvantaged communities. Their research will fuel both solutions for those communities and future improvements to the First Street model and information products. Reducing the nation’s flood risk exposure will be a costly and often painful experience for many in the short term, but we are committed to publicly providing an assessment of everyone’s risk because meaningful progress cannot be made without everyone fully understanding the scope and severity of the flood risk problem. We hope that all may be equally empowered by this information to take steps to avoid an even more costly and painful personal scenario: being totally unprepared for a flood in one’s home.

Acknowledgments

The First Street Foundation, a 501(c)(3) nonprofit registered in the District of Columbia, acknowledges the outstanding contributions from Paul Bates, Andrew Smith, Chis Sampson, and Niall Quinn (Fathom); Kerry Emmanuel (Massachusetts Institute of Technology); Celso Ferreira and Arslaan Khalid (George Mason University); and Michael Delgado, Ali Hamidi, and Trevor Houser (Rhodium Group). First Street is grateful for the availability of data from the USGS, NOAA, USACE, and LightBox.

References

Bin, O., and C. E. Landry (2013), Changes in implicit flood risk premiums: Empirical evidence from the housing market, J. Environ. Econ. Manage., 65(3), 361–376, https://doi.org/10.1016/j.jeem.2012.12.002.

Emanuel, K. (2017), Assessing the present and future probability of Hurricane Harvey’s rainfall, Proc. Natl. Acad. Sci. U. S. A., 114(48), 12,681–12,684, https://doi.org/10.1073/pnas.1716222114.

Kopp, R. E., et al. (2017), Evolving understanding of Antarctic ice-sheet physics and ambiguity in probabilistic sea-level projections, Earth’s Future, 5(12), 1,217–1,233, https://doi.org/10.1002/2017EF000663.

Kunkel, K. E., et al. (2020), Precipitation extremes: Trends and relationships with average precipitation and precipitable water in the contiguous United States, J. Appl. Meteorol. Climatol., 59(1), 125–142, https://doi.org/10.1175/JAMC-D-19-0185.1.

McAlpine, S. A., and J. R. Porter (2018), Estimating recent local impacts of sea-level rise on current real-estate losses: A housing market case study in Miami-Dade, Florida, Popul. Res. Policy Rev., 37, 871–895, https://doi.org/10.1007/s11113-018-9473-5.

Moss, R. H., et al. (2010), The next generation of scenarios for climate change research and assessment, Nature, 463, 747–756, https://doi.org/10.1038/nature08823.

Wing, O. E. J., et al. (2017), Validation of a 30 m resolution flood hazard model of the conterminous United States, Water Resour. Res., 53(9), 7,968–7,986, https://doi.org/10.1002/2017WR020917.

Author Information

Edward J. Kearns ([email protected]) and Michael Amodeo, First Street Foundation, Brooklyn, N.Y.; and Jeremy Porter, First Street Foundation, Brooklyn, N.Y.; also at Environmental Health Sciences Department, Columbia University, New York, N.Y., and Quantitative Methods in Social Sciences Program, City University of New York, N.Y.

Citation:

Kearns, E. J., Amodeo, M., and Porter, J. (2020), Do you know your home’s flood risk?, Eos, 101, https://doi.org/10.1029/2020EO146389. Published on 29 June 2020.

Text © 2020. The authors. CC BY-NC-ND 3.0

Except where otherwise noted, images are subject to copyright. Any reuse without express permission from the copyright owner is prohibited.